Personal Income Protection

If you become unable to work because of illness or injury, would you be able to meet your current financial obligations and maintain your standard of living? Without proper income protection you would likely have to change your current lifestyle and even give up your future dreams.

Individual Disability Income Insurance

Individual Disability Income Insurance provides monthly benefits to help cover daily living expenses. This personal income protection allows you to maintain your lifestyle without having to drain your savings or investments. It helps protect you and your family in a time of need. It is basic coverage you cannot afford not to have.

Individual Disability Income insurance can be offered on a stand-alone basis or supplement a group long-term disability insurance plan. An individual DI insurance policy is completely portable.

Business Continuation or Business Disability Income Insurance

Offering employees a well-rounded competitive benefits package that includes income protection is one of the best strategies for companies to attract and keep the top talented employees.

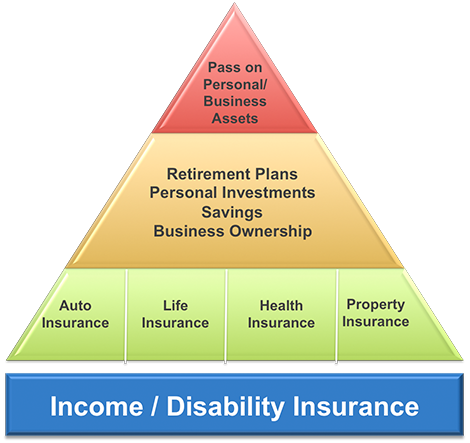

How solid is your financial foundation?

Income is the foundation of a solid financial strategy.

Without it, everything else, including your dreams for the future, crumble.

What is your earnings potential?

What would you do if you were too sick or hurt to work?

If you are like most people, you cannot afford an early retirement because of an injury or illness making you unable to work.

Potential earnings to age 65 (with 5% annual salary increases)

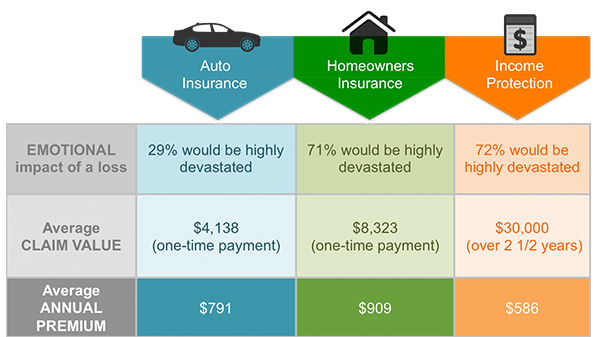

It is important to protect your home and car.

It is more important to protect yourself and your future. Other risk protection solutions, including disability income insurance help protect you and your future.

[ssba]